Notice of Court Ordered Meeting

NOTICE IS HEREBY GIVEN that by an order of the Federal High Court (the Court) dated 5th day of August 2022 (the Order) made in the above matter, the Court has directed that a meeting (the “COM” or “Meeting”) of the holders of the fully paid-up ordinary shares of Sterling Bank PLC (“Bank”) be convened for the purpose of considering and if thought fit, approving, with or without modification, a Scheme of Arrangement (the “Scheme”) between the Bank and the holders of the fully paid-up ordinary shares of 50 Kobo each in the Bank (the “Holders”) in accordance with Section 715 of the Companies and Allied Matters Act, No. 3 of 2020 (as amended), incorporating a carve-out and transfer of the Non-Interest Banking Business under Section 711 of the Companies and Allied Matters Act, No. 3 of 2020 (as amended).

Frequently Asked

Questions (FAQs)

Frequently Asked

Questions (FAQs)

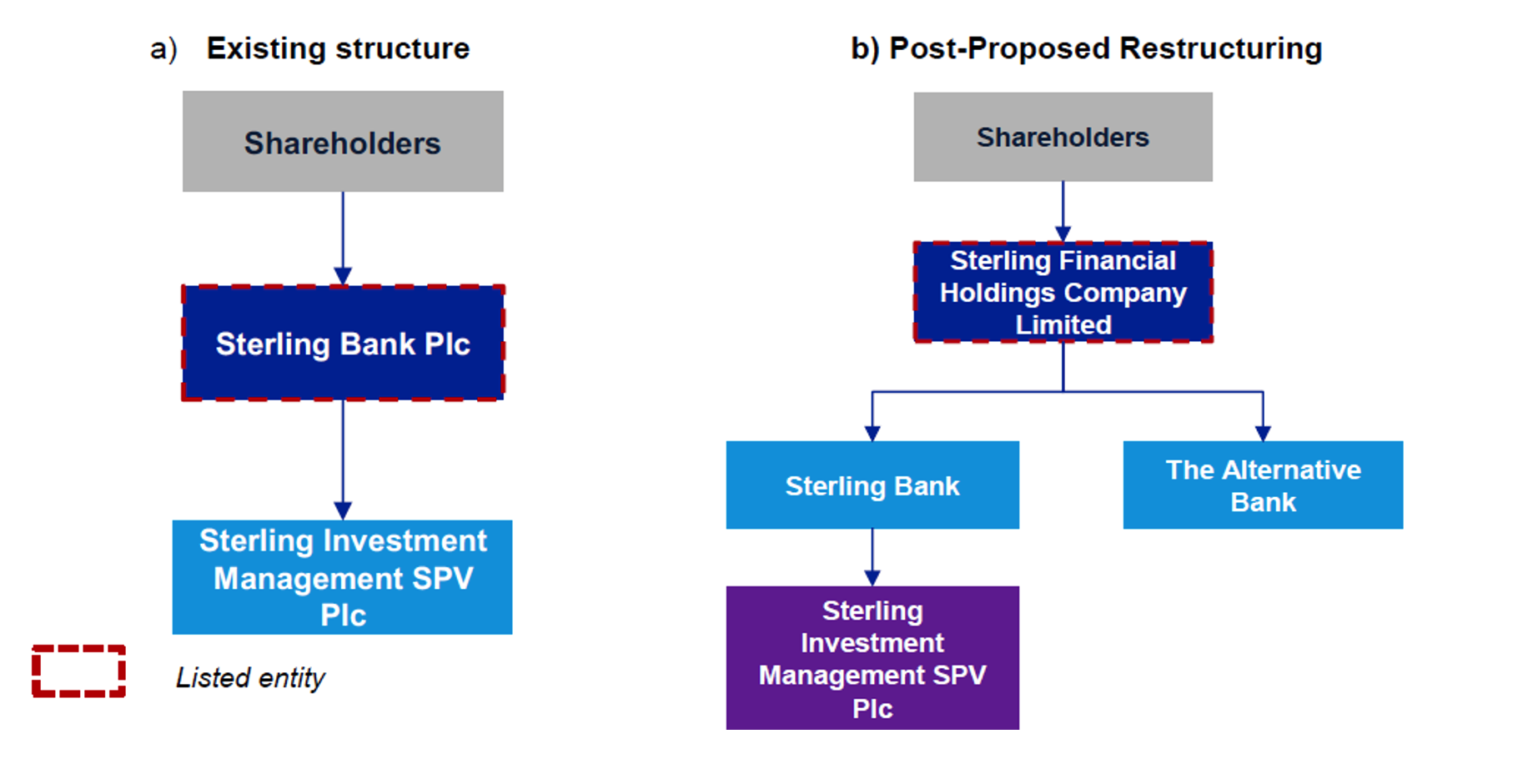

Sterling Bank PLC (“Sterling Bank” or the “Bank”) is transitioning to a holding company through a Scheme of Arrangement between the Bank and its Shareholders (the “Scheme” or “Proposed Transaction”). The Proposed Transaction will provide for the creation of a new non-operating holding company named Sterling Financial Holdings Company Limited (the “HoldCo”), which will wholly own Sterling Bank and the non-interest bank (“The Alternative Bank Limited”).

Sterling Bank is converting to a holding company to allow its shareholders to maintain continued exposure to the Bank’s existing lines of business and gain exposure to new permissible business lines that would enhance stakeholders’ value, by providing the Bank with the flexibility to pursue such opportunities and diversify.

The Bank intends to spin-off its non-interest banking business which currently operates as a window of the Bank. However, under the Central Bank of Nigeria’s (“CBN”) regulations, the Bank’s current structure limits its ability to do this. The holding company structure will facilitate a consolidated financial strength of the group and provide the subsidiaries access to group-wide expertise of the parent company model; it will also allow the Bank to position itself for growth within the fast-evolving financial services industry.

The Bank’s shareholders will be entitled to consider and approve the Proposed Transaction at a Court Ordered Meeting (“COM”), scheduled to hold on the 19th of September 2022. At the COM, the shareholders will vote on the resolutions to effect the Scheme / Proposed Transaction. The Scheme is to be approved, with or without modification(s), by a resolution of a majority representing three-quarters (¾) in value of the shares held by the Bank’s shareholders present and voting either in person or by proxy at the COM

- The meeting / COM will hold at 10.00 am on Monday, 19th of September 2022 at Shell Hall, Muson Centre, Onikan Lagos, Nigeria.

- In the interest of public safety and having due regard to the Nigeria Centre for Disease Control (NCDC) COVID-19 Guidance for Safe Mass Gatherings in Nigeria, only the Selected Proxies listed in the Scheme document and on the Proxy Form would be allowed to attend the COM physically. All other shareholders would be required to attend the COM virtually via www.sterling.ng/meeting and to vote through a proxy. The Proxy Form and Selected Proxies can be found on page 58 of the Scheme document.

- Sterling Bank will seek the formal approval of the Securities and Exchange Commission (“SEC”) and the sanction of the Court, to make the Scheme effective.

- Sterling Bank will subsequently apply to have its shares delisted from Nigerian Exchange Limited (“NGX”) and in its place, the HoldCo Shares will be listed thereon. Shareholders will exchange their shares in Sterling Bank for shares in HoldCo in the same proportion as their current holdings in the Bank.

- Sterling Bank PLC will be converted to a private company – Sterling Bank Limited, which will become a subsidiary of HoldCo.

- No, Shareholders will not receive cash.

- The Proposed Transaction is a share-for-share exchange, where shareholders will exchange their shares in Sterling Bank for shares in HoldCo, in the same proportion as their current holdings in the Bank. The Proposed Transaction will not result in any adverse changes to the rights and ownership of existing shareholders of Sterling Bank.

The newly created non-operating holding company called Sterling Financial Holdings Company Limited (which will be converted to a PLC upon the Scheme becoming effective) will be listed on the NGX, whilst Sterling Bank PLC will be delisted.

HoldCo shares will be listed at the same price as the last trading price of the shares of Sterling Bank Plc on the day they are delisted from NGX.

The Bank’s non-interest banking customers will be moved to The Alternative Bank Limited, which will be held as a subsidiary of HoldCo. Whilst the remaining customers of Sterling Bank PLC will be housed under Sterling Bank Limited, which will also be a subsidiary of HoldCo.

- Upon the completion of the Scheme, all employees of Sterling Bank will have opportunities within HoldCo’s businesses.

- Employees of the non-interest banking business will be redeployed to become employees of The Alternative Bank Limited.

Many of the current directors of Sterling Bank PLC will continue to be directors of Sterling Bank Limited. However, a few may be moved to some of the emerging entities either to serve fully or as cross directors.

The Scheme will be completed when the shares of HoldCo are listed on the NGX – the tentative date for the listing of HoldCo shares is 26 October 2022.