- Personal

Self Service

-

Open AccountOpen Account

-

Manage AccountManage Account

E-BANKING

-

Download OneBankDownload OneBank

Mobile App

Mobile App

Accounts

-

Savings AccountsSavings Accounts

-

Current AccountsCurrent Accounts

-

Investment AccountsInvestment Accounts

-

More ...More ...

-

- Business

Corporate

-

CardsCards

-

SWAY AgFinSWAY AgFin

-

Omni XOmni X

-

Agric SummitAgric Summit

E-BANKING

-

Sterling ProSterling Pro

Corporate Internet Banking

Corporate Internet Banking

H.E.A.R.T

-

HealthHealth

-

EducationEducation

-

AgricultureAgriculture

-

Renewable EnergyRenewable Energy

-

TransportationTransportation

-

- About Us

-

Board of DirectorsBoard of Directors

-

Executive ManagementExecutive Management

-

EventsEvents

-

Our BlogOur Blog

-

Our PolicyOur Policy

-

- Careers

-

Life at SterlingLife at Sterling

-

InternshipInternship

-

Graduate TraineeGraduate Trainee

-

Experienced HiresExperienced Hires

-

Gig ItGig It

-

Grow with SterlingGrow with Sterling

-

- Investors

-

Investors OverviewInvestors Overview

-

Investors ReportInvestors Report

-

Investor NewsInvestor News

-

RatingsRatings

-

- Help

-

How to file complaintsHow to file complaints

-

Help CenterHelp Center

-

ATM LocatorATM Locator

-

Agent ListAgent List

-

Submit FeedbackSubmit Feedback

-

Whistle BlowingWhistle Blowing

-

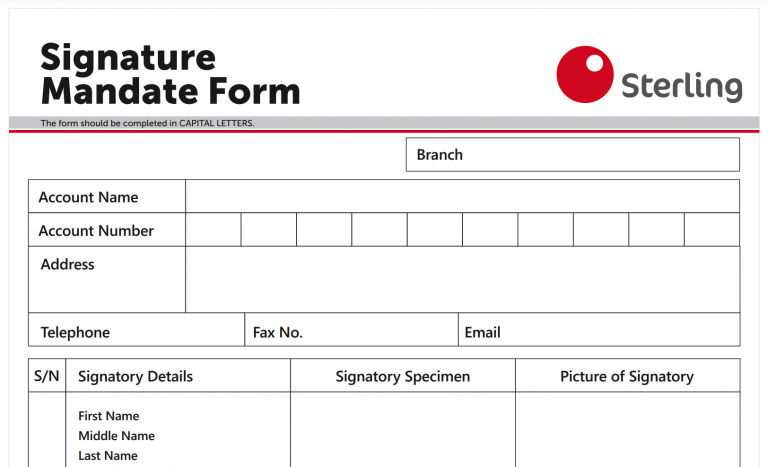

Download FormsDownload Forms

-

Self CertificationSelf Certification

-

- Internet Banking

-

Download OneBank

Mobile AppPersonalDownload OneBank

Mobile App -

Sterling Pro

BusinessSterling Pro

BusinessSterling Pro

-

Download OneBank

Mobile AppPersonalDownload OneBank

Mobile App -

Sterling Pro

BusinessSterling Pro

BusinessSterling Pro -

Internet Banking

My OneBank WebPersonalInternet Banking

My OneBank Web

-

- Personal

Self Service

-

Open AccountOpen Account

-

Manage AccountManage Account

E-BANKING

-

Internet BankingInternet Banking

My OneBank Web

My OneBank Web -

Download OneBankDownload OneBank

Mobile App

Mobile App

Accounts

-

Savings AccountsSavings Accounts

-

Current AccountsCurrent Accounts

-

Investment AccountsInvestment Accounts

-

More ...More ...

-

- Business

Corporate

-

CardsCards

-

SWAY AgFinSWAY AgFin

-

Omni XOmni X

-

Agric SummitAgric Summit

E-BANKING

-

Sterling ProSterling Pro

Corporate Internet Banking

Corporate Internet Banking

H.E.A.R.T

-

HealthHealth

-

EducationEducation

-

AgricultureAgriculture

-

Renewable EnergyRenewable Energy

-

TransportationTransportation

-

- About Us

-

Board of DirectorsBoard of Directors

-

Executive ManagementExecutive Management

-

Our AwardsOur Awards

-

EventsEvents

-

Our PolicyOur Policy

-

- Blog

- Careers

-

Life at SterlingLife at Sterling

-

InternshipInternship

-

Graduate TraineeGraduate Trainee

-

Experienced HiresExperienced Hires

-

Gig ItGig It

-

Grow with SterlingGrow with Sterling

-

- Investor Relations

-

Investors OverviewInvestors Overview

-

Investors ReportInvestors Report

-

Investor NewsInvestor News

-

RatingsRatings

-

- Help

-

How to file complaintsHow to file complaints

-

Help CenterHelp Center

-

ATM LocatorATM Locator

-

Agent ListAgent List

-

Submit FeedbackSubmit Feedback

-

Whistle BlowingWhistle Blowing

-

Download FormsDownload Forms

-

Self CertificationSelf Certification

-